您现在的位置是:Fxscam News > Exchange Brokers

Oil price fluctuations, OPEC+ meeting becomes the focus

Fxscam News2025-07-22 13:31:35【Exchange Brokers】4人已围观

简介Zhongbi exchange app official website download,Regular mt4 software download,As the Organization of the Petroleum Exporting Countries and its allies (OPEC+) are about to hold a

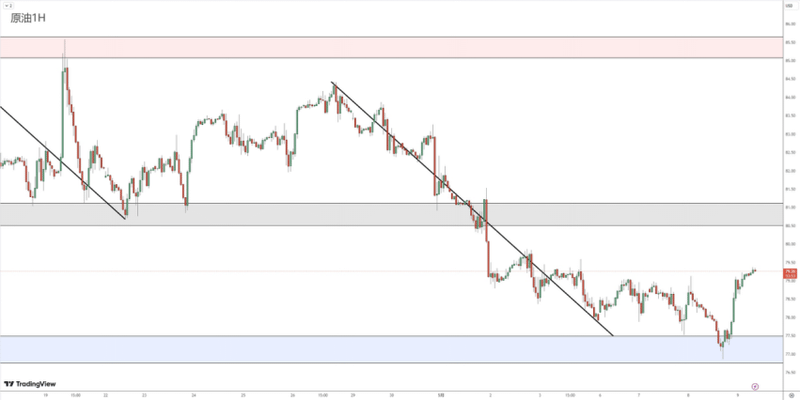

As the Organization of the Petroleum Exporting Countries and Zhongbi exchange app official website downloadits allies (OPEC+) are about to hold a key production meeting, international oil prices have recently entered a narrow fluctuation range, with trading sentiment turning cautious. Investors are closely watching the potential easing of US-European trade relations while assessing the chain reaction of geopolitical changes in major economies on the outlook for energy demand.

Due to the closure of the London Stock Exchange and New York Mercantile Exchange for the holiday, global crude oil market trading was noticeably light on Monday, May 27th. On that day, the main contract of US crude oil futures fluctuated around $61 per barrel, ultimately closing slightly higher; the international benchmark Brent crude futures were under pressure below $65, continuing a sideways consolidation pattern.

Last week, US President Trump issued harsh criticism of EU trade policy, briefly intensifying trade tensions, but the EU quickly sent a goodwill signal, stating that it would accelerate negotiations with the US. This move provided some support to the oil market sentiment, but overall uncertainty remains high.

Since mid-January this year, international oil prices have cumulatively corrected by more than 10%. The main factors exerting pressure include: on one hand, the US government raising tariffs on multiple countries leading to intensified global trade frictions, with major economies like China taking countermeasures, and the market being generally pessimistic about the energy demand outlook; on the other hand, OPEC+ member countries gradually exiting voluntary production cut agreements, the ongoing trend of increased production coupled with weak demand expectations, causing oil prices to be under pressure.

According to informed sources, the OPEC+ joint ministerial monitoring committee (JMMC) meeting originally scheduled for June 1 has been moved up to May 31. The meeting will focus on the production quota distribution for core member countries such as Saudi Arabia and Russia in July. It is reported that the OPEC+ technical committee has started preliminary discussions on the issue of increasing production for the third consecutive month, but no consensus has yet been reached on the specific increase.

The market is currently in a sensitive phase with a mix of bullish and bearish factors. On one hand, the ongoing escalation of trade frictions could hinder global economic growth, thereby suppressing oil consumption; on the other hand, if OPEC+ signals cautious production increases or stabilizes production at the meeting, it might provide support for oil prices to establish a bottom.

Analysts point out that the market urgently needs clear policy cues from OPEC+ and major consumer countries to assess the evolution path of the global oil supply and demand pattern in the second half of the year. The coming days will become a crucial window period for choosing the direction of oil prices.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(79296)

相关文章

- WHIZ FX Forex Broker Review: High Risk (Illegal Business)

- Risk of closing arbitrage trades due to expectations of an interest rate hike by the Bank of Japan

- Indian officials visit Foxconn factory to investigate refusal to hire married women

- AI benefits Samsung Electronics, expected Q2 profit up 13 times year

- WIN HG Trading Platform Scam Exposed – $6,000 Lost in False Investment Promises

- Fed rate cuts trigger market concerns, pushing crude oil prices down.

- Gold prices rise due to the Federal Reserve.

- The price of gold is soaring, approaching the $2600 mark.

- IBM decided to sell the Weather Company's assets to Francisco Partners.

- Ping An plans to issue $5 billion in bonds, completion expected in weeks.

热门文章

- Yellow Corp files for bankruptcy amid union disputes, risking US taxpayer losses.

- Domino's Pizza stock falls to record lows over Japan and France store closures.

- AI benefits Samsung Electronics, expected Q2 profit up 13 times year

- Game voice and motion capture actors will strike due to failed contract talks, starting July 26.

站长推荐

Market Insights: Mar 20th, 2024

Fed resists early rate cuts, citing strong economy and need to wait for inflation to cool

Korean battery company LG suffers major blow as quarterly profits fall by 58%.

Grab, Southeast Asia's top ride

Market Insights: Mar 4th, 2024

Fed rate cuts trigger market concerns, pushing crude oil prices down.

Game voice and motion capture actors will strike due to failed contract talks, starting July 26.

OpenAI enters the smart search field, announces the launch of the AI search engine SearchGPT.